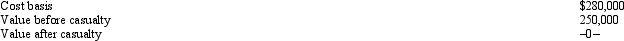

In 2013,Grant's personal residence was completely destroyed by fire.Grant was insured for 100% of his actual loss,and he received the insurance settlement.Grant had adjusted gross income,before considering the casualty item,of $30,000.Pertinent data with respect to the residence follows:  What is Grant's allowable casualty loss deduction?

What is Grant's allowable casualty loss deduction?

A) $0.

B) $6,500.

C) $6,900.

D) $10,000.

E) $80,000.

Correct Answer:

Verified

Q26: Lucy owns and actively participates in the

Q48: Carl, a physician, earns $200,000 from his

Q52: Nell sells a passive activity with an

Q65: Jon owns an apartment building in which

Q79: In 2013,Wally had the following insured personal

Q81: Art's at-risk amount in a passive activity

Q83: Tonya had the following items for last

Q84: Kate dies owning a passive activity with

Q85: If a taxpayer has an NOL in

Q86: Maria,who is single,had the following items for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents