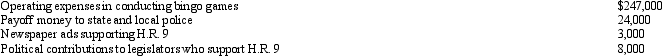

Rex,a cash basis calendar year taxpayer,runs a bingo operation which is illegal under state law.During 2013,a bill designated H.R.9 is introduced into the state legislature which,if enacted,would legitimize bingo games.In 2013,Rex had the following expenses:  Of these expenditures,Rex may deduct:

Of these expenditures,Rex may deduct:

A) $247,000.

B) $250,000.

C) $258,000.

D) $282,000.

E) None of the above.

Correct Answer:

Verified

Q62: Which of the following may be deductible?

A)Bribes

Q64: On January 2,2013,Fran acquires a business from

Q66: Hippo,Inc.,a calendar year C corporation,manufactures golf gloves.For

Q66: For a president of a publicly held

Q70: Tom operates an illegal drug-running operation and

Q72: During the current year,Owl Corporation (a C

Q81: Which of the following is not a

Q83: In January, Lance sold stock with a

Q90: Which of the following must be capitalized

Q93: Nikeya sells land (adjusted basis of $120,000)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents