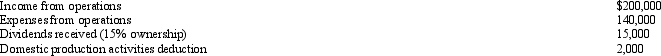

During the current year,Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

A) $9,000.

B) $7,500.

C) $6,650.

D) $6,450.

E) None of the above.

Correct Answer:

Verified

Q29: Cost depletion is determined by multiplying the

Q57: The basis of an asset on which

Q58: If a used $35,000 automobile used 100%

Q60: The § 179 deduction can exceed $500,000

Q64: On January 2,2013,Fran acquires a business from

Q66: Hippo,Inc.,a calendar year C corporation,manufactures golf gloves.For

Q74: Tommy, an automobile mechanic employed by an

Q75: Which of the following is a required

Q78: Which of the following legal expenses are

Q81: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents