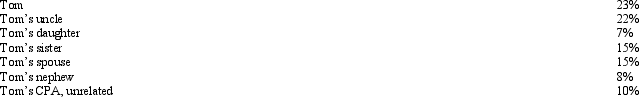

The stock of Eagle,Inc.is owned as follows:

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom's realized loss is $13,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: During the past two years, through extensive

Q131: Alfred's Enterprises,an unincorporated entity,pays employee salaries of

Q132: While she was a college student,Angel lived

Q133: On January 15,2013,Vern purchased the rights to

Q134: On June 1,2013,Red Corporation purchased an existing

Q135: Sandra owns an insurance agency.The following selected

Q137: Janet is the CEO for Silver,Inc.,a closely

Q138: Walter sells land with an adjusted basis

Q139: Albie operates an illegal drug-running business and

Q144: Briefly discuss the disallowance of deductions for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents