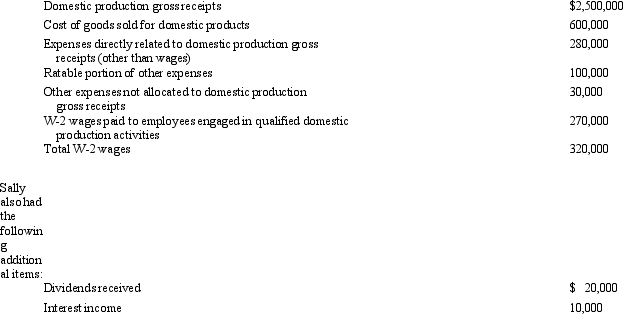

Red Company is a proprietorship owned by Sally,a single individual.Red manufactures and sells widgets.During 2013,an examination of Red's records shows the following items:

Determine Sally's domestic production activities deduction for 2013.

Determine Sally's domestic production activities deduction for 2013.

Correct Answer:

Verified

Q132: Briefly discuss the two tests that an

Q136: Bruce owns several sole proprietorships. Must Bruce

Q136: Bobby operates a drug-trafficking business. Because he

Q139: Are there any circumstances under which lobbying

Q141: In a related-party transaction where realized loss

Q148: Norm purchases a new sports utility vehicle

Q150: Rustin bought used 7-year class property on

Q152: Olive, Inc., an accrual method taxpayer, is

Q154: If part of a shareholder/employee's salary is

Q156: Max opened his dental practice (a sole

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents