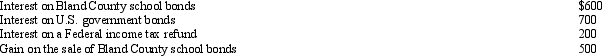

Heather's interest and gains on investments for 2013 were as follows:  Heather's gross income from the above is:

Heather's gross income from the above is:

A) $2,000.

B) $1,800.

C) $1,400.

D) $1,300.

E) None of the above.

Correct Answer:

Verified

Q28: The taxpayer's marginal tax bracket is 25%.

Q37: Carin, a widow, elected to receive the

Q50: Swan Finance Company, an accrual method taxpayer,

Q62: In December 2013,Todd,a cash basis taxpayer,paid $1,200

Q63: George,an unmarried cash basis taxpayer,received the following

Q69: Theresa,a cash basis taxpayer,purchased a bond on

Q86: On January 1, Father (Dave) loaned Daughter

Q94: Sarah, a majority shareholder in Teal, Inc.,

Q100: The effects of a below-market loan for

Q110: Margaret owns land that appreciates at the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents