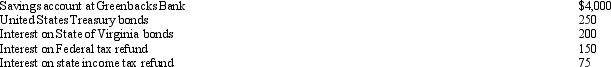

Doug and Pattie received the following interest income in the current year:  Greenbacks Bank also gave Doug and Pattie a cellular phone (worth $100) for opening the savings account.What amount of interest income should they report on their joint income tax return?

Greenbacks Bank also gave Doug and Pattie a cellular phone (worth $100) for opening the savings account.What amount of interest income should they report on their joint income tax return?

A) $4,775.

B) $4,675.

C) $4,575.

D) $4,300.

E) None of the above.

Correct Answer:

Verified

Q52: Turquoise Company purchased a life insurance policy

Q56: Iris collected $150,000 on her deceased husband's

Q74: Tonya is a cash basis taxpayer.In 2013,she

Q80: Darryl,a cash basis taxpayer,gave 1,000 shares of

Q81: In January 2013,Tammy purchased a bond due

Q83: Roy is considering purchasing land for $10,000.He

Q85: Juan was considering purchasing an interest in

Q98: Emily is in the 35% marginal tax

Q100: The purpose of the tax rules that

Q117: Our tax laws encourage taxpayers to _

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents