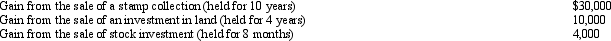

Perry is in the 33% tax bracket.During 2013,he had the following capital asset transactions:  Perry's tax consequences from these gains are as follows:

Perry's tax consequences from these gains are as follows:

A) (15% ´ $30,000) + (33% ´ $4,000) .

B) (15% ´ $10,000) + (28% ´ $30,000) + (33% ´ $4,000) .

C) (0% ´ $10,000) + (28% ´ $30,000) + (33% ´ $4,000) .

D) (15% ´ $40,000) + (33% ´ $4,000) .

E) None of the above.

Correct Answer:

Verified

Q82: Hazel, a solvent individual but a recovering

Q85: Gold Company was experiencing financial difficulties, but

Q90: Flora Company owed $95,000, a debt incurred

Q90: On January 1,2013,Faye gave Todd,her son,a 36-month

Q93: On January 1,2003,Cardinal Corporation issued 5% 25-year

Q96: For the current year,David has salary income

Q96: Harold bought land from Jewel for $150,000.Harold

Q100: Margaret made a $90,000 interest-free loan to

Q104: During the year, Kim sold the following

Q112: Ted was shopping for a new automobile.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents