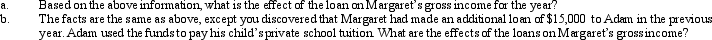

Margaret made a $90,000 interest-free loan to her son,Adam,who used the money to retire a mortgage on his personal residence and to buy a certificate of deposit.Adam's only income for the year is his salary of $35,000 and $1,400 interest income on the certificate of deposit.The relevant Federal interest rate is 8% compounded semiannually.The loan is outstanding for the entire year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Gold Company was experiencing financial difficulties, but

Q95: Perry is in the 33% tax bracket.During

Q96: Harold bought land from Jewel for $150,000.Harold

Q96: For the current year,David has salary income

Q101: During 2013,Jackson had the following capital gains

Q104: Sally and Ed each own property with

Q105: In early 2013,Ben sold a yacht,held for

Q107: If a tax-exempt bond will yield approximately

Q112: Ted was shopping for a new automobile.

Q123: Rachel owns rental properties. When Rachel rents

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents