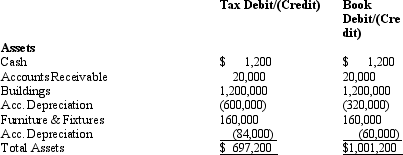

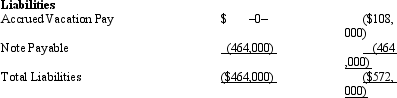

Amelia,Inc.,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

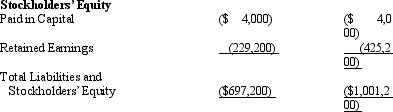

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

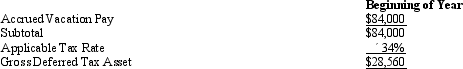

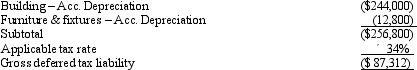

Amelia,Inc.'s,book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Determine the net deferred tax asset or net deferred tax liability at year end.

Amelia,Inc.'s,book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Determine the net deferred tax asset or net deferred tax liability at year end.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: Which of the following statements best describes

Q53: Healy, Inc., reports an effective tax rate

Q57: Cold,Inc.,reported a $100,000 total tax expense for

Q59: South,Inc.,earns book net income before tax of

Q61: Black,Inc.,is a domestic corporation with the following

Q63: Black,Inc.,is a domestic corporation with the following

Q64: After applying the balance sheet method to

Q65: Amelia,Inc.,is a domestic corporation with the following

Q67: Amelia,Inc.,is a domestic corporation with the following

Q75: At the beginning of the year, the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents