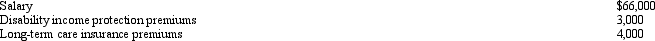

James,a cash basis taxpayer,received the following compensation and fringe benefits in 2013:  His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

A) $66,000.

B) $72,000.

C) $73,000.

D) $75,000.

E) None of the above.

Correct Answer:

Verified

Q55: Julie was suffering from a viral infection

Q61: Adam repairs power lines for the Egret

Q63: An employee can exclude from gross income

Q63: Peggy is an executive for the Tan

Q67: The Perfection Tax Service gives employees $12.50

Q68: Ridge is the manager of a motel.As

Q74: The employees of Mauve Accounting Services are

Q75: Heather is a full-time employee of the

Q91: A worker may prefer to be classified

Q100: A worker may prefer to be treated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents