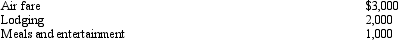

During the year,Walt travels from Seattle to Tokyo (Japan) on business.His time was spent as follows: 2 days travel (one day each way) ,2 days business,and 2 days personal.His expenses for the trip were as follows (meals and lodging reflect only the business portion) :  Presuming no reimbursement,Walt's deductible expenses are:

Presuming no reimbursement,Walt's deductible expenses are:

A) $3,500.

B) $4,500.

C) $5,500.

D) $6,000.

E) None of the above.

Correct Answer:

Verified

Q90: The § 222 deduction for tuition and

Q93: When using the automatic mileage method, which,

Q106: Frank established a Roth IRA at age

Q107: Mary establishes a Roth IRA at age

Q116: Amy works as an auditor for a

Q118: Louise works in a foreign branch of

Q119: During the year,Sophie went from Omaha to

Q121: Joyce,age 40,and Sam,age 42,who have been married

Q123: Juanita receives a $2,000 distribution from her

Q125: Sammy,age 31,is unmarried and is not an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents