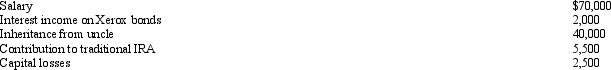

During 2013,Esther had the following transactions:  Esther's AGI is:

Esther's AGI is:

A) $62,000.

B) $64,000.

C) $67,000.

D) $102,000.

E) $104,000.

Correct Answer:

Verified

Q22: Child care payments to a relative are

Q27: Child and dependent care expenses include amounts

Q35: For purposes of computing the credit for

Q36: Both education tax credits are available for

Q51: Expenses that are reimbursed by a taxpayer's

Q55: An individual generally may claim a credit

Q63: Which, if any, of the statements regarding

Q72: Which, if any, of the following is

Q86: During 2013,Marvin had the following transactions:

Q93: During 2013,Sarah had the following transactions:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents