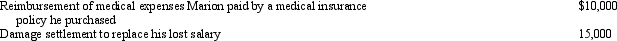

Early in the year,Marion was in an automobile accident during the course of his employment.As a result of the physical injuries he sustained,he received the following payments during the year:  What is the amount that Marion must include in gross income for the current year?

What is the amount that Marion must include in gross income for the current year?

A) $25,000.

B) $15,000.

C) $12,500.

D) $10,000.

E) $0.

Correct Answer:

Verified

Q49: A scholarship recipient at State University may

Q84: In which, if any, of the following

Q84: Thelma and Mitch were divorced.The couple had

Q99: Assuming a taxpayer qualifies for the exclusion

Q117: The Hutters filed a joint return for

Q118: Nelda is married to Chad,who abandoned her

Q119: In 2013,Cindy had the following transactions:

Q121: In 2013,Boris pays a $3,800 premium for

Q123: In 2013,Khalid was in an automobile accident

Q125: Richard,age 50,is employed as an actuary.For calendar

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents