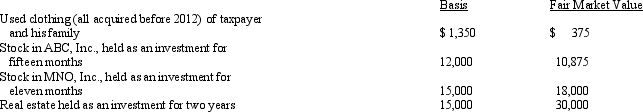

Zeke made the following donations to qualified charitable organizations during 2013:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2013 is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2013 is:

A) $43,350.

B) $56,250.

C) $59,250.

D) $60,375.

E) None of the above.

Correct Answer:

Verified

Q63: Byron owned stock in Blossom Corporation that

Q86: George and Martha are married and file

Q98: Which of the following items would be

Q100: Kevin and Sue have two children, ages

Q150: Jermaine and Kesha are married,file a joint

Q151: Warren,age 17,is claimed as a dependent by

Q153: In 2012,Juan and Juanita incur $9,800 in

Q154: Brad,who uses the cash method of accounting,lives

Q159: In 2013,Jerry pays $8,000 to become a

Q160: Which of the following statements regarding the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents