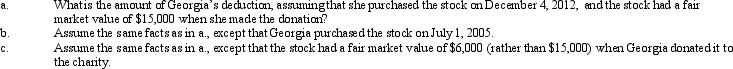

Georgia had AGI of $100,000 in 2013.She donated Heron Corporation stock with a basis of $8,500 to a qualified charitable organization on July 5,2013.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: George and Martha are married and file

Q100: Kevin and Sue have two children, ages

Q132: In order to claim a dependency exemption

Q136: In meeting the criteria of a qualifying

Q152: During the current year, Doris received a

Q159: In 2013,Jerry pays $8,000 to become a

Q160: Which of the following statements regarding the

Q161: Barbara was injured in an automobile accident.She

Q166: In 2006,Ross,who is single,purchased a personal residence

Q167: Marilyn,age 38,is employed as an architect.For calendar

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents