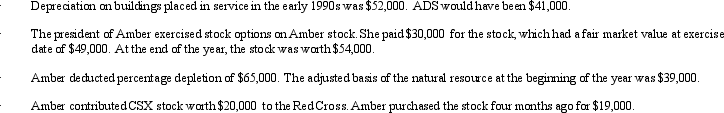

Amber,Inc.,has taxable income of $212,000.In addition,Amber accumulates the following information which may affect its AMT.  What is Amber's AMTI?

What is Amber's AMTI?

A) $212,000.

B) $233,000.

C) $238,000.

D) $249,000.

E) None of the above

Correct Answer:

Verified

Q6: An S corporation election for Federal income

Q21: A benefit of an S corporation when

Q26: Actual dividends paid to shareholders result in

Q30: John wants to buy a business whose

Q32: Molly transfers land with an adjusted basis

Q36: A shareholder's basis in the stock of

Q45: Wally contributes land (adjusted basis of $30,000;

Q48: Section 1244 ordinary loss treatment is available

Q50: Which of the following statements is correct?

A)

Q52: If an individual contributes an appreciated personal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents