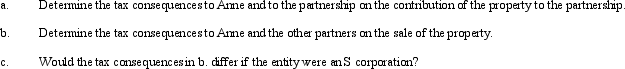

Anne contributes property to the TCA Partnership which was formed 8 years ago by Clark and Tara.Anne's basis for the property is $90,000 and the fair market value is $220,000.Anne receives a 25% interest for her contribution.Because the TCA Partnership is unsuccessful in having the property rezoned from agricultural to commercial,it sells the property 14 months later for $225,000.

Correct Answer:

Verified

Q88: How can double taxation be avoided or

Q105: With respect to special allocations, is the

Q116: Under what circumstances, if any, do the

Q117: List some techniques for reducing and/or avoiding

Q118: Ralph owns all the stock of Silver,Inc.,a

Q118: Why does stock redemption treatment for an

Q119: To which of the following entities does

Q121: Ralph wants to purchase either the stock

Q125: In the sale of a partnership, does

Q125: Dudley has a 20% ownership interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents