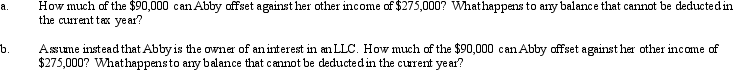

Abby is a limited partner in a limited partnership.Her basis in the partnership interest is $80,000 with an at-risk basis of $75,000.Abby's share of the partnership loss for the tax year is $90,000.She has other income of $275,000.

Correct Answer:

Verified

Q90: Which of the following statements is correct?

A)

Q97: Mr.and Ms.Smith's partnership owns the following assets:

Q99: Albert's sole proprietorship owns the following assets:

Q100: Blue,Inc.,has taxable income before salary payments to

Q101: Included among the factors that influence the

Q102: What tax rates apply for the AMT

Q103: List some techniques which can be used

Q105: Meg has an adjusted basis of $150,000

Q108: Pelican, Inc., a C corporation, distributes $275,000

Q110: What special adjustment is required in calculating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents