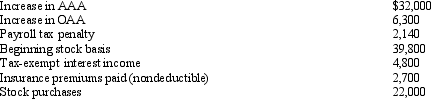

You are given the following facts about a 50% owner of an S corporation.Compute his ending stock basis.

A) $80,950.

B) $85,750.

C) $100,100.

D) $106,225.

E) Some other amount.

Correct Answer:

Verified

Q82: On January 1, Bobby and Alice own

Q89: Samantha owned 1,000 shares in Evita,Inc.,an S

Q89: Which transaction affects the Other Adjustments Account

Q90: Fred is the sole shareholder of an

Q92: A calendar year C corporation reports a

Q93: You are given the following facts

Q96: During 2013,Oxen Corporation incurs the following transactions.

Q97: During 2013,Miles Nutt,the sole shareholder of a

Q99: On January 1, 2014, Kinney, Inc., an

Q99: Which of the following reduces a shareholder's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents