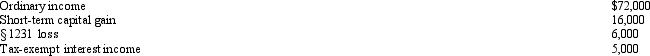

Gene Grams is a 45% owner of a calendar year S corporation during 2013.His beginning stock basis is $230,000,and the S corporation reports the following items.

Calculate Grams's stock basis at year-end.

Calculate Grams's stock basis at year-end.

Correct Answer:

Verified

Q104: Grams,Inc. ,a calendar year S corporation is

Q104: Which tax provision does not apply to

Q117: Yates Corporation elects S status,effective for calendar

Q118: An S corporation's separately stated items generally

Q119: Some _ taxation rules apply to an

Q123: Bidden,Inc.,a calendar year S corporation,incurred the following

Q124: An S corporation's LIFO recapture amount equals

Q125: Individuals Adam and Bonnie form an S

Q126: Towne,Inc.,a calendar year S corporation,holds AAA of

Q138: Pepper,Inc.,an S corporation in Norfolk,Virginia,has revenues of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents