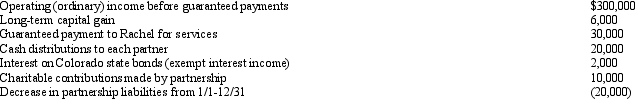

An examination of the RB Partnership's tax books provides the following information for the current year:

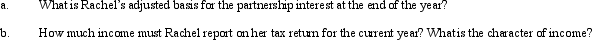

Rachel is a 30% general partner in partnership capital,profits,and losses.Assume the adjusted basis of her partnership interest is $60,000 at the beginning of the year,and she shares in 30% of the partnership's liabilities for basis purposes.

Rachel is a 30% general partner in partnership capital,profits,and losses.Assume the adjusted basis of her partnership interest is $60,000 at the beginning of the year,and she shares in 30% of the partnership's liabilities for basis purposes.

Correct Answer:

Verified

Q74: Palmer contributes property with a fair market

Q76: Samuel is the managing general partner of

Q81: During the current tax year, Jordan and

Q83: Jeordie and Kendis created the JK Partnership

Q100: Which of the following statements is correct

Q105: At the beginning of the tax year,Zach's

Q108: During the current year,MAC Partnership reported the

Q114: The LN partnership reported the following items

Q221: On the formation of a partnership, when

Q225: Your client owns a parcel of land

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents