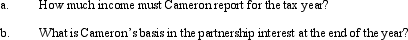

In the current year,the CAR Partnership received revenues of $400,000 and paid the following amounts: $160,000 in rent,utilities,and salaries; a $40,000 guaranteed payment to partner Ryan; $20,000 to partner Amy for consulting services; and a $40,000 distribution to 25% partner Cameron.In addition,the partnership realized a $12,000 net long-term capital gain.Cameron's basis in his partnership interest was $60,000 at the beginning of the year,and included his $25,000 share of partnership liabilities.At the end of the year,his share of partnership liabilities was $15,000.

Correct Answer:

Verified

Q63: George and James are forming the GJ

Q67: Molly is a 30% partner in the

Q69: The MOP Partnership is involved in

Q81: During the current tax year, Jordan and

Q83: Jeordie and Kendis created the JK Partnership

Q100: Which of the following statements is correct

Q108: Which of the following is not a

Q109: Paul sells one parcel of land (basis

Q114: The LN partnership reported the following items

Q132: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents