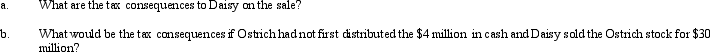

Daisy Corporation is the sole shareholder of Ostrich Corporation,which it hopes to sell within the next three years.The Ostrich stock (basis of $25 million)is currently worth $30 million,but Daisy believes that it would be easier to find a buyer if it was worth less.To lower the value of its stock,Ostrich distributes $4 million cash to Daisy (sufficient E & P exists to cover the distribution).At a later date,Daisy sells Ostrich for $26 million.

Correct Answer:

Verified

Q96: Brown Corporation,an accrual basis corporation,has taxable income

Q97: Albatross Corporation acquired land for investment purposes

Q146: Lena is the sole shareholder and president

Q155: Finch Corporation (E & P of $400,000)

Q162: Briefly discuss the rules related to distributions

Q168: Provide a brief outline on computing current

Q169: How does the definition of accumulated E

Q170: Briefly describe the reason a corporation might

Q173: Timothy owns 100% of Forsythia Corporation's stock.

Q175: Briefly define the term "earnings and profits."

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents