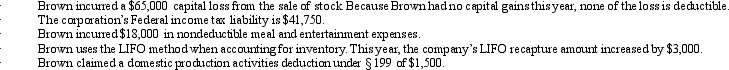

Brown Corporation,an accrual basis corporation,has taxable income of $150,000 in the current year.Included in its determination of taxable income are the following transactions.

What is Brown's current E & P for the year?

What is Brown's current E & P for the year?

Correct Answer:

Verified

Q93: Steve has a capital loss carryover in

Q94: Puce Corporation,an accrual basis taxpayer,has struggled to

Q97: Albatross Corporation acquired land for investment purposes

Q100: Daisy Corporation is the sole shareholder of

Q145: Scarlet Corporation is an accrual basis, calendar

Q146: Lena is the sole shareholder and president

Q155: Finch Corporation (E & P of $400,000)

Q160: On January 1, Tulip Corporation (a calendar

Q169: How does the definition of accumulated E

Q173: Timothy owns 100% of Forsythia Corporation's stock.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents