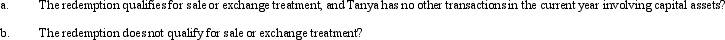

Tanya is in the 33% tax bracket.She acquired 1,000 shares of stock in Swan Corporation seven years ago for $100 a share.In the current year,Swan Corporation (E & P of $1.2 million)redeems all of her shares for $160,000.What are the income tax consequences to Tanya if:

Correct Answer:

Verified

Q82: Ivory Corporation (E & P of $1

Q89: Kite Corporation,a calendar year taxpayer,has taxable

Q142: At the beginning of the current year,

Q145: Scarlet Corporation is an accrual basis, calendar

Q147: Stephanie is the sole shareholder and president

Q152: Ashley, the sole shareholder of Hawk Corporation,

Q153: Jen, the sole shareholder of Mahogany Corporation,

Q154: Sylvia owns 25% of Cormorant Corporation. Cormorant

Q158: Thrush, Inc., is a calendar year, accrual

Q165: Gold Corporation has accumulated E & P

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents