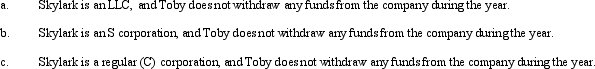

During the current year,Skylark Company had operating income of $420,000 and operating expenses of $250,000.In addition,Skylark had a long-term capital loss of $20,000,and a charitable contribution of $5,000.How does Toby,the sole owner of Skylark Company,report this information on his individual income tax return under following assumptions?

Correct Answer:

Verified

Q64: Dawn is the sole shareholder of Thrush

Q78: Several years ago,Logan purchased extra grazing

Q81: Which, if any, of the following transactions

Q83: State and local governments are sometimes forced

Q86: In 2011,Deborah became 65 years old.In 2012

Q88: A taxpayer is considering the formation of

Q102: Which, if any, of the following provisions

Q117: Both economic and social considerations can be

Q123: Morgan inherits her father's personal residence including

Q201: The tax law allows an income tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents