Happy Nails is a locally owned nail salon that is in its first year of business. The nail salon employs 8 nail technicians that are

Happy Nails is a locally owned nail salon that is in its first year of business. The nail salon employs 8 nail technicians that are

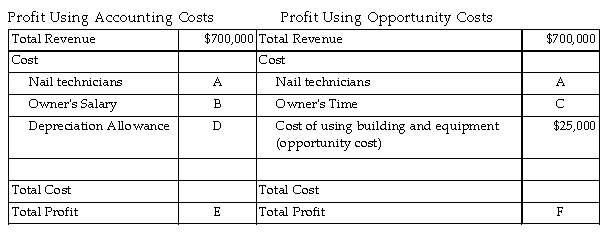

$31,250 each and the owner's is paid $75,000. If the owner did not own Happy Nails, she would work for a competitor for $85 the beginning of the year, the building and the salon equipment are worth $100,000 and at the end of the year, they are worth The accountant for Happy Nails uses straight- line depreciation for the 15- year life of the building and salon equipment. The table above provides some additional information on revenue and the opportunity cost of using the building and equipment.

-Refer to the table above. What is the value of A?

A) $62,500

B) $250,000

C) $312,500

D) $31,250

Correct Answer:

Verified

Q36: Which type of firm pays dividends?

A)proprietorship

B)partnership

C)corporation

D)limited liability

Q37: If Big Brothers Hot Dog stand sold

Q38: A partnership can be owned by just

Q39: A cabinet firm paid $5,000 for 10,000

Q40: Total revenue is equal to

A)price x quantity

B)price

Q42: A florist paid $1,200 for 500 glass

Q43: Managers should use straight- line depreciation when

Q44: Big Trucking Company has purchased a $100,000

Q45: Suppose you have recently graduated and have

Q46: Effective profit- maximizing managers work hard to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents