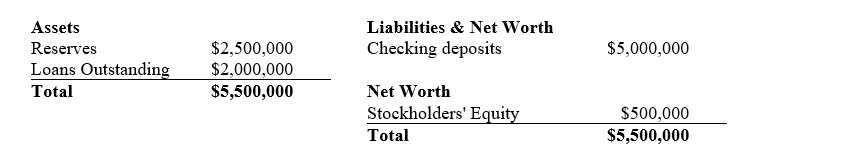

If the reserve ratio was 10% for the bank with the balance sheet listed below, then this bank is being

A) aggressive as indicated by a small amount of excess reserves.

B) aggressive as indicated by a large amount of excess reserves.

C) cautious as indicated by a small amount of excess reserves.

D) cautious as indicated by a large amount of excess reserves.

Correct Answer:

Verified

Q24: A bank would be considered insolvent when

Q26: The central idea behind the Troubled Asset

Q27: Which of the following was not a

Q28: The increased level of excess reserves that

Q31: The Fed's loan that effectively nationalized AIG

Q31: When the housing bubble burst, prices fell

Q32: What is the leverage implied by the

Q33: If a 10-year Treasury bond pays 1.5%

Q34: A bubble is best defined as

A)an increase

Q35: If a 10-year Treasury bond pays 3.1%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents