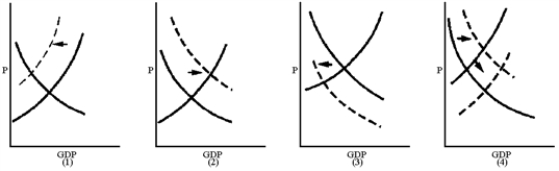

Figure 11-2

-The Bush tax cuts

A) reduced tax rates for the upper brackets and increased tax rates for lower-income taxpayers.

B) reduced tax rates for the upper brackets and held constant tax rates for lower-income taxpayers.

C) reduced tax rates for the upper brackets and decreased tax rates for lower-income taxpayers.

D) held constant tax rates for the upper brackets and decreased tax rates for lower-income taxpayers.

E) Increased tax rates for the upper brackets and decreased tax rates for lower-income taxpayers.

Correct Answer:

Verified

Q167: Figure 11-2 Q168: Figure 11-2 Q169: Supply-side tax cuts designed to increase investment Q170: Supply-side tax cuts are more likely to Q171: Capital gains tax cuts inevitably benefit Q173: The primary goal of supply-side economics is Q174: Critics of supply-side economics argue that tax Q175: Supply-side tax cuts tend to benefit the Q176: Federal budget deficits are often increased by Q177: Critics of supply-side economics argue that a

![]()

![]()

A)low-income workers.

B)retired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents