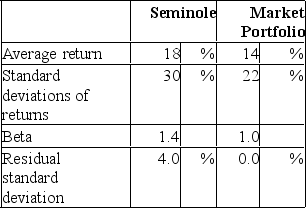

The following data are available relating to the performance of Seminole Fund and the market portfolio:  The risk-free return during the sample period was 6%.

The risk-free return during the sample period was 6%.

If you wanted to evaluate the Seminole Fund using theM2measure, what percent of the adjusted portfolio would need to be invested in T-Bills?

A) -36% (borrow)

B) 50%

C) 8%

D) 36%

E) 27%

Correct Answer:

Verified

Q23: The following data are available relating to

Q25: The following data are available relating to

Q25: Suppose you purchase one share of the

Q26: The following data are available relating to

Q29: Suppose you buy 100 shares of Abolishing

Q30: The following data are available relating to

Q32: The following data are available relating to

Q38: Suppose you purchase one share of the

Q40: Suppose you purchase one share of the

Q42: If an investor has a portfolio that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents