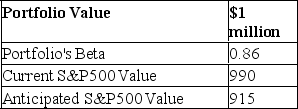

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  What is the dollar value of your expected loss?

What is the dollar value of your expected loss?

A) $142,900

B) $65,200

C) $85,700

D) $30,000

Correct Answer:

Verified

Q28: Which two indices had the lowest correlation

Q34: One reason swaps are desirable is that

A)

Q41: If interest rate parity holds,

A)covered interest arbitrage

Q43: If covered interest arbitrage opportunities exist,

A)interest rate

Q45: You are given the following information about

Q46: The most common short-term interest rate used

Q47: If covered interest arbitrage opportunities do not

Q48: A hedge ratio can be computed as

A)

Q48: You are given the following information about

Q49: Covered interest arbitrage

A)ensures that currency futures prices

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents