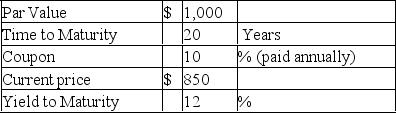

Given the bond described above, if interest were paid semi-annually (rather than annually) , and the bond continued to be priced at $850, the resulting effective annual yield to maturity would be

Given the bond described above, if interest were paid semi-annually (rather than annually) , and the bond continued to be priced at $850, the resulting effective annual yield to maturity would be

A) less than 12%.

B) more than 12%.

C) 12%.

D) Cannot be determined.

Correct Answer:

Verified

Q21: An upward-sloping yield curve

A)may be an indication

Q22: Suppose that all investors expect that interest

Q23: The "break-even" interest rate for year n

Q24: The yield curve is a component of

A)the

Q25: The yield curve

A)is a graphical depiction of

Q27: Forward rates _ future short rates because

Q29: Suppose that all investors expect that interest

Q30: Investors can use publicly available financial data

Q31: Suppose that all investors expect that interest

Q34: The on the run yield curve is

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents