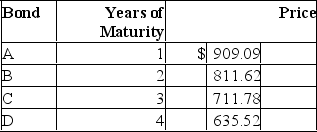

Consider the following $1,000-par-value zero-coupon bonds:  The yield to maturity on bond B is

The yield to maturity on bond B is

A) 10%.

B) 11%.

C) 12%.

D) 14%.

Correct Answer:

Verified

Q38: A coupon bond that pays interest annually

Q39: A coupon bond that pays interest semi-annually

Q40: You purchased an annual interest coupon bond

Q41: A 10% coupon bond maturing in 10

Q42: A bond will sell at a discount

Q44: The _ is used to calculate the

Q45: A coupon bond pays interest semi-annually, matures

Q46: You have just purchased a 10-year zero-coupon

Q47: You purchased an annual-interest coupon bond one

Q48: A convertible bond has a par value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents