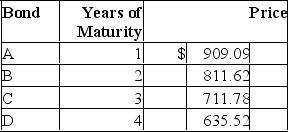

Consider the following $1,000-par-value zero-coupon bonds:  The yield to maturity on bond D is

The yield to maturity on bond D is

A) 10%.

B) 11%.

C) 12%.

D) 14%.

Correct Answer:

Verified

Q44: The _ is used to calculate the

Q45: A coupon bond pays interest semi-annually, matures

Q46: You have just purchased a 10-year zero-coupon

Q47: You purchased an annual-interest coupon bond one

Q48: A convertible bond has a par value

Q50: A convertible bond has a par value

Q51: A Treasury bill with a par value

Q52: A Treasury bill with a par value

Q53: A 10% coupon bond with annual payments

Q54: A 12% coupon bond with semi-annual payments

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents