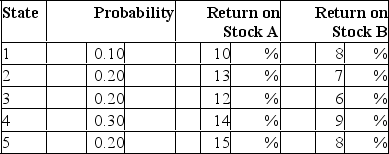

Consider the following probability distribution for stocks A and B:  The variances of stocks A and B are _____ and _____, respectively.

The variances of stocks A and B are _____ and _____, respectively.

A) 1.5%; 1.9%

B) 2.2%; 1.2%

C) 3.2%; 2.0%

D) 1.5%; 1.1%

Correct Answer:

Verified

Q12: Diversifiable risk is also referred to as

A)

Q16: Which of the following statement(s) is(are) true

Q18: The expected return of a portfolio of

Q19: The variance of a portfolio of risky

Q20: Which of the following statement(s) is(are) false

Q23: Which statement about portfolio diversification is correct?

A)Proper

Q25: Consider the following probability distribution for stocks

Q26: Which one of the following portfolios cannot

Q27: The measure of risk in a Markowitz

Q40: The unsystematic risk of a specific security

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents