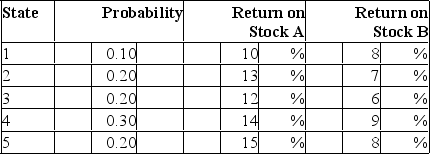

Consider the following probability distribution for stocks A and B:  The expected rate of return and standard deviation of the global minimum variance portfolio, G, are __________ and __________, respectively.

The expected rate of return and standard deviation of the global minimum variance portfolio, G, are __________ and __________, respectively.

A) 10.07%; 1.05%

B) 8.97%; 2.03%

C) 10.07%; 3.01%

D) 8.97%; 1.05%

Correct Answer:

Verified

Q31: Which of the following is not a

Q32: Consider the following probability distribution for stocks

Q33: The individual investor's optimal portfolio is designated

Q34: Which one of the following portfolios cannot

Q35: Consider the following probability distribution for stocks

Q37: In a two-security minimum variance portfolio where

Q38: Security X has expected return of 12%

Q39: The global minimum variance portfolio formed from

Q40: An investor who wishes to form a

Q41: Consider the following probability distribution for stocks

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents