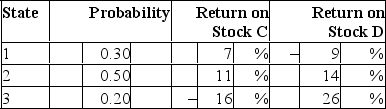

Consider the following probability distribution for stocks C and D:  The expected rates of return of stocks C and D are _____ and _____, respectively.

The expected rates of return of stocks C and D are _____ and _____, respectively.

A) 4.4%; 9.5%

B) 9.5%; 4.4%

C) 6.3%; 8.7%

D) 8.7%; 6.2%

Correct Answer:

Verified

Q43: Consider the following probability distribution for stocks

Q44: Given an optimal risky portfolio with expected

Q45: Security X has expected return of 14%

Q46: The line representing all combinations of portfolio

Q47: The separation property refers to the conclusion

Q49: The risk that can be diversified away

Q50: Consider the following probability distribution for stocks

Q51: When two risky securities that are positively

Q52: In words, the covariance considers the probability

Q53: Consider the following probability distribution for stocks

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents