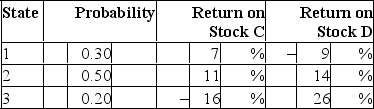

Consider the following probability distribution for stocks C and D:  The standard deviations of stocks C and D are _____ and _____, respectively.

The standard deviations of stocks C and D are _____ and _____, respectively.

A) 7.62%; 11.24%

B) 11.24%; 7.62%

C) 10.35%; 12.93%

D) 12.93%; 10.35%

Correct Answer:

Verified

Q53: Consider the following probability distribution for stocks

Q54: Consider the following probability distribution for stocks

Q55: Given an optimal risky portfolio with expected

Q56: The standard deviation of a two-asset portfolio

Q57: Consider two perfectly negatively correlated risky securities,

Q58: Consider the following probability distribution for stocks

Q60: As the number of securities in a

Q61: Security X has expected return of 7%

Q62: Security M has expected return of 17%

Q63: Consider two perfectly negatively correlated risky securities,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents