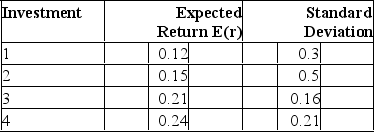

Use the below information to answer the following question.  U=E(r) - (A/2) s2,whereA= 4.0.

U=E(r) - (A/2) s2,whereA= 4.0.

Which investment would you select if you were risk neutral?

A) 1

B) 2

C) 3

D) 4

Correct Answer:

Verified

Q6: The certainty equivalent rate of a portfolio

Q7: Elias is a risk-averse investor.David is a

Q8: Consider a risky portfolio, A, with an

Q9: When an investment advisor attempts to determine

Q10: The presence of risk means that

A)investors will

Q11: A portfolio has an expected rate of

Q12: In the mean-standard deviation graph, an indifference

Q13: In a return-standard deviation space, which of

Q14: Use the below information to answer the

Q15: A fair game

A)will not be undertaken by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents