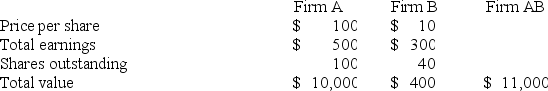

The following data on a merger are given:

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. Calculate the NPV of the merger.

A) $200

B) $400

C) $600

D) $150

Correct Answer:

Verified

Q34: Given the following data, Q35: Suppose that the market price of Company Q36: Antitrust law can be enforced by the Q37: The following data on a merger are Q38: Firm A is planning to acquire Firm Q40: The following data on a merger are Q41: The easiest task for the managers of Q42: The following are methods available to change Q43: If Firm A acquires Firm B for Q44: Takeover defenses appear to favor![]()

A)stockholders.

B)workers.

C)creditors.

D)managers.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents