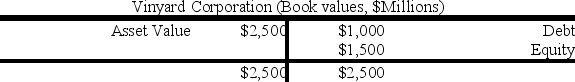

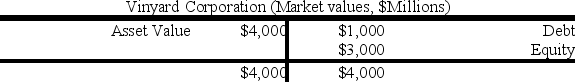

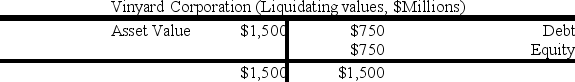

Given are the following data for Vinyard Corporation:

Calculate the proportions of debt (D/V) and equity (E/V) that you would use for estimating Vinyard's weighted average cost of capital (WACC) .

A) 40 percent debt and 60 percent equity

B) 50 percent debt and 50 percent equity

C) 25 percent debt and 75 percent equity

D) 75 percent debt and 25 percent equity

Correct Answer:

Verified

Q15: Given are the following data for year

Q16: Consider the following data for Kriya Company:

Q17: Given are the following data for year

Q18: When one uses the after-tax weighted average

Q19: Consider the following data:

FCF1 = $7 million;

Q21: The Granite Paving Company is all-equity financed

Q22: The opportunity cost of capital, used to

Q23: The 1-year bonds of Casino, Inc., have

Q24: Financial practitioners usually include short-term debt in

Q25: A firm finances itself with 30 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents