Sun Corporation has had returns of -6 percent, 16 percent, 18 percent, and 28 percent for the past four years. Calculate the standard deviation of the returns using the correction for the loss of a degree of freedom shown below.

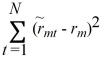

When variance is estimated from a sample of observed returns, we add the squared deviations and divide by N -1, where N is the number of observations. We divide by N -1 rather than N to correct for a loss of a degree of freedom. The formula is

Variance(

m ) =

Where

m is the market return in period t and rm is the mean of the values of rmt.

A) 11.6 percent

B) 14.3 percent

C) 13.4 percent

D) 14.0 percent

Correct Answer:

Verified

Q31: Which portfolio had the highest standard deviation

Q32: Unique risk is also called

A)systematic risk.

B)non-diversifiable risk.

C)firm-specific

Q33: If the correlation coefficient between the returns

Q34: If the covariance between stock A and

Q35: What range of values can correlation coefficients

Q37: Stock A has an expected return of

Q38: For a two-stock portfolio, the maximum reduction

Q39: The type of the risk that can

Q40: As the number of stocks in a

Q41: The covariance between Amazon stock and the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents