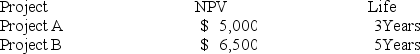

Two mutually exclusive projects have the following positive NPVs and project lives.

If the cost of capital were 15 percent, which project would you accept?

A) Project A, because it has higher EAC

B) Project B, because it has higher EAC

C) Project A, because its NPV can be earned more quickly

D) Project B, because it has higher NPV

Correct Answer:

Verified

Q45: By undertaking an analysis in real terms,

Q46: You are considering the purchase of one

Q47: Opportunity costs should not be included in

Q48: Working capital is one of the most

Q49: Germany allows firms to choose the depreciation

Q51: A financial analyst should include interest and

Q52: Depreciation expense acts as a tax shield

Q53: Using the technique of equivalent annual cash

Q54: A project requires an initial investment of

Q55: A project requires an investment of $900

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents