Use the information for the question(s)below.

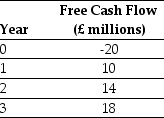

Luther Industries,a U.S.Corporation,is considering a new project located in Great Britain.The expected free cash flows from the project are detailed below:  You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

-What is the dollar present value of the project?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Use the following information to answer the

Q21: Use the information for the question(s)below.

Luther Industries,a

Q22: The provision of the Tax Cuts and

Q23: Use the information for the question(s)below.

KT Enterprises,a

Q24: Use the following information to answer the

Q26: Use the following information to answer the

Q27: Which of the following statements regarding the

Q28: Use the information for the question(s)below.

KT Enterprises,a

Q29: Luther Industries,a U.S.firm,is considering an investment in

Q30: Use the information for the question(s)below.

KT Enterprises,a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents