Use the information for the question(s)below.

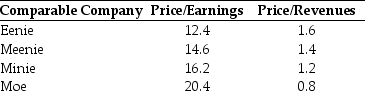

During the most recent fiscal year,KD Industries had revenues of $400 million and earnings of $30 million.KD has filed a registration statement with the SEC for its IPO.Before it is offered,KD's investment bankers would like to estimate the value of the company using comparable companies.The investment bankers have assembled the following information based on data for other companies in the same industry that have recently gone public.In each case,the ratios are based upon the IPO price.

-Based upon the price/earnings ratio,what would be a reasonable value for KD?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: Use the information for the question(s)below.

During the

Q26: Which of the following statements is FALSE?

A)Once

Q27: Use the information for the question(s)below.

Luther Industries

Q28: Use the following information to answer the

Q29: Use the information for the question(s)below.

Luther Industries

Q31: Use the following information to answer the

Q32: Use the information for the question(s)below.

Luther Industries

Q33: Use the following information to answer the

Q34: Aaron Inc went public at $10 per

Q35: When referring to IPOs,what is book building?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents