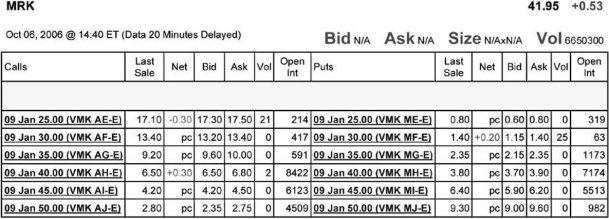

Use the table for the question(s)below.

Consider the following information on options from the CBOE for Merck:

-You have decided to sell (write)five January 2009 put options on Merck with an exercise price of $45 per share.How much money will you receive and are these contracts in or out of the money?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: The writer of a call option has:

A)the

Q3: As the seller of an option,you are

Q4: The payoff to the holder of a

Q5: Use the table for the question(s)below.

Consider the

Q6: The payoff to the holder of a

Q8: The holder of a put option has:

A)the

Q9: Using options to place a bet on

Q10: Use the figure for the question(s)below.

Q11: Which of the following statements is FALSE?

A)Options

Q12: Which of the following statements is FALSE?

A)An

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents