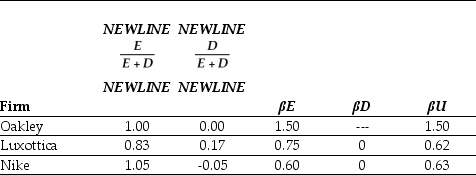

Use the table for the question(s) below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Oakley is closest to:

A) 13.5%.

B) 10.2%.

C) 9.1%.

D) 14.7%.

Correct Answer:

Verified

Q24: Use the tables for the question(s)below.

Pro Forma

Q25: Use the table for the question(s)below.

Pro Forma

Q26: Use the tables for the question(s)below.

Pro Forma

Q27: Use the table for the question(s)below.

Pro Forma

Q28: Use the table for the question(s)below.

Pro Forma

Q30: Use the table for the question(s)below.

Pro Forma

Q31: Use the table for the question(s)below.

Pro Forma

Q32: Use the table for the question(s)below.

Capital Structure

Q33: Use the table for the question(s)below.

Capital Structure

Q34: Use the tables for the question(s)below.

Pro Forma

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents