Use the information for the question(s)below.

KD Industries has 30 million shares outstanding with a market price of $20 per share and no debt.KD has had consistently stable earnings,and pays a 35% tax rate.Management plans to borrow $200 million on a permanent basis through a leveraged recapitalization in which they would use the borrowed funds to repurchase outstanding shares.

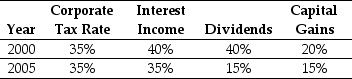

-Assume the following tax schedule:

Personal Tax Rates  Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: Consider the following formula: τ* =

Q80: Use the information for the question(s)below.

Shepard Industries

Q81: Which of the following statements is FALSE?

A)The

Q82: Which of the following statements is FALSE?

A)If

Q83: With its current leverage,WELS Corporation will have

Q85: Use the table for the question(s)below.

Consider the

Q86: Use the table for the question(s)below.

Consider the

Q87: Use the table for the question(s)below.

Consider the

Q88: Which of the following statements is FALSE?

A)Even

Q89: Which of the following statements is FALSE?

A)Even

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents