Use the following information to answer the question(s) below.

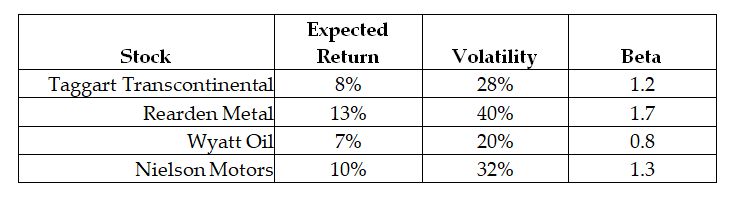

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-Which of the following stocks represent selling opportunities?

1.Taggart Transcontinental

2.Rearden Metal

3.Wyatt Oil

4.Nielson Motors

A) 1 only

B) 1 and 2 only

C) 2 and 3 only

D) 2 and 4 only

Correct Answer:

Verified

Q1: Use the following information to answer the

Q2: Use the following information to answer the

Q3: Use the following information to answer the

Q4: If investors believe that others have superior

Q5: The CAPM does not require that investors

Q7: Which of the following statements is FALSE?

A)A

Q8: Which of the following is NOT true

Q9: The tendency of uninformed individuals to overestimate

Q10: When all investors correctly interpret and use

Q11: Investors that suffer from a familiarity bias:

A)prefer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents